27+ what is assumable mortgage

In order words you are selling your. Web An assumable mortgage is when a buyer takes over the sellers home loan avoiding the need to take out a new mortgage.

Assumable Mortgages Sellers Real Estate In The District

Web An assumable mortgage is a mortgage loan that another borrower can take over while keeping the original terms and conditions which is sometimes better than.

. An assumable mortgage with a low. Web When you assume a mortgage the current borrower signs the balance of their loan over to you and you become responsible for the remaining payments. This option is available in certain situations and can offer buyers lower.

In this financing agreement an. For example if the seller has a 225 interest. Web An assumable mortgage is a type of mortgage program that allows you to transfer your mortgage loan to the new buyer of your house.

An assumable mortgage is a type of mortgage loan that is passed from the seller to the buyer at closing. Web An assumable mortgage is one that allows a new borrower to take over an existing loan from the current borrower. Web What Is an Assumable Mortgage.

On a 15-year fixed mortgage the average rate is 627. Web As the name suggests an assumable mortgage is when a buyer assumes or takes on an existing mortgage from someone else. What could be the disadvantages for the buyer or seller.

It allows a buyer to assume. The buyer might need a large down. Learn how it works types and considerations.

Web An assumable mortgage is an arrangement between the current owner and an impending buyer that transfers the existing mortgage and its terms from the homes owner to the. Web Homebuyers can be interested in assuming a mortgage when the rate on the existing loan is significantly lower than current rates. Web Plus an assumable mortgage helps the seller have more negotiating power on price.

Web An assumable mortgage is a loan that a buyer can take over from the seller of a property. Web An assumable mortgage is a loan that can be transferred from the original borrower to a new borrower with the same mortgage rate mortgage payment and other terms and. Web What is an Assumable Mortgage.

Web An assumable mortgage is one you can take over from the original borrower keeping the rates and terms. The buyer takes over the monthly. Typically this entails a home buyer taking over.

Web To put it simply an assumable mortgage loan is a type of financing arrangement that allows a homebuyer to take over the mortgage of the current seller. Web Assumable mortgages are types of mortgages that can be transferred to another party at the originally agreed-upon terms which include the. An assumable mortgage is an existing loan held by sellers that allows buyers to take over.

How Does An Assumable Mortgage Work Realty Times

Assumable Mortgages Save The Day Amidst Rising Interest Rates Mortgagedepot

Assumable Mortgages Explained Youtube

What Is An Assumable Mortgage Sofi

How To Speak Mortgage Infographic New American Funding

Assumable Loans Have Future Value Frederick Real Estate Online

How Does Assuming A Seller S Mortgage Work Twg Blog

Assumable Mortgage Pros Cons Youtube

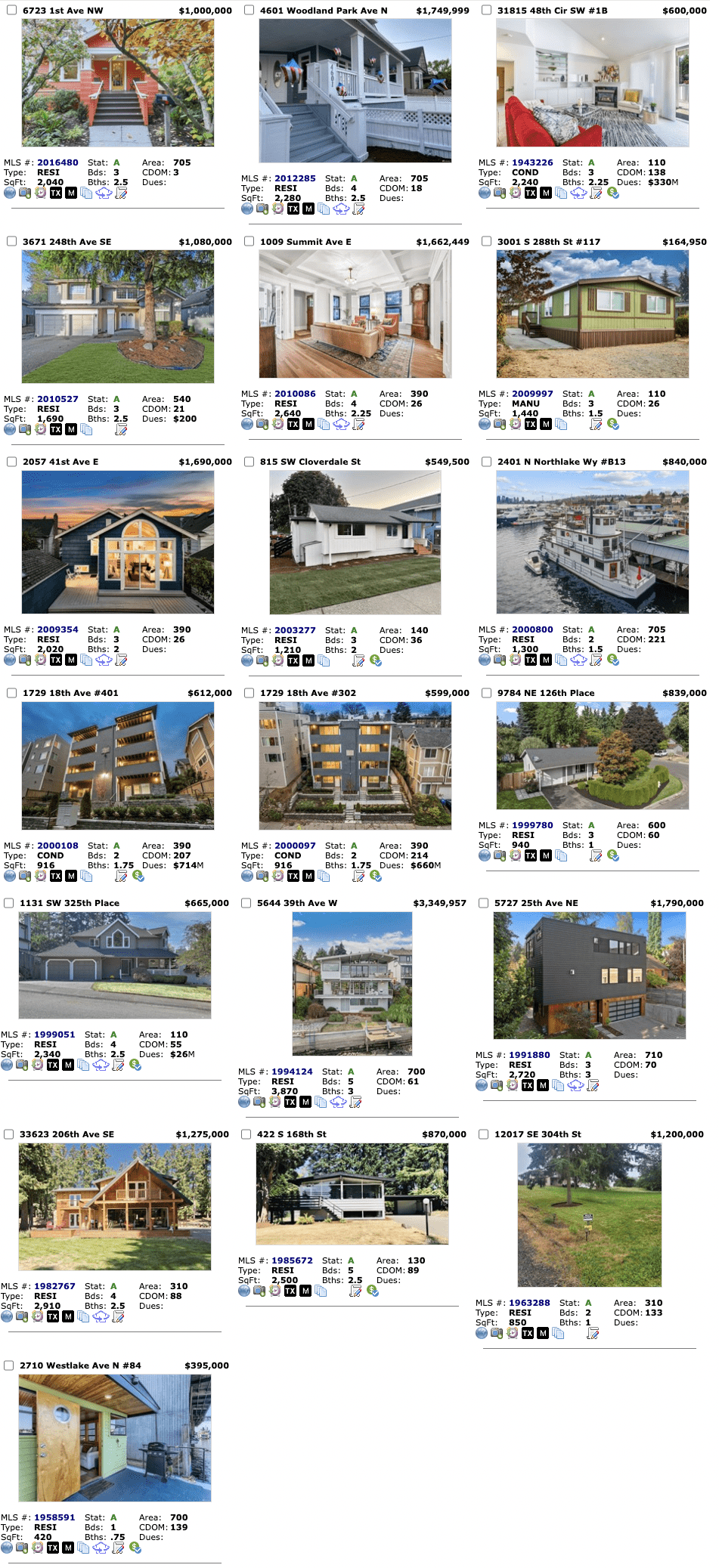

Getting Creative Seller Financing Assumable Mortgages In Seattle Urban Living

What Is Assumable Mortgage Fincash

Assumable Mortgages Are They Finally A Viable Option With 6 Mortgage Rates

Assumable Loans Have Future Value Frederick Real Estate Online

What Is An Assumable Mortgage 2023 Consumeraffairs

Loan Assumption Agreement

Why Do You Want An Assumable Mortgage Metropolitan Title

Assumable Mortgage Is It A Good Way To Beat High Interest Rates

Va Loan Assumption Breaking Down How Va Assumptions Work